work opportunity tax credit questionnaire social security number

April 27 2022 by Erin Forst EA. It says on the questionnaire the completion is optional but on the Panera site it says I.

Should I Give My Social Security Number To A Job I Applied To Regal Cinemas Which Sent A Confirmation Email Telling Me That To Complete The Application Process I Must Complete The

Completing Your WOTC Questionnaire.

. They are allowed to ask you to fill out these forms. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment barriers eg veterans ex-felons etc.

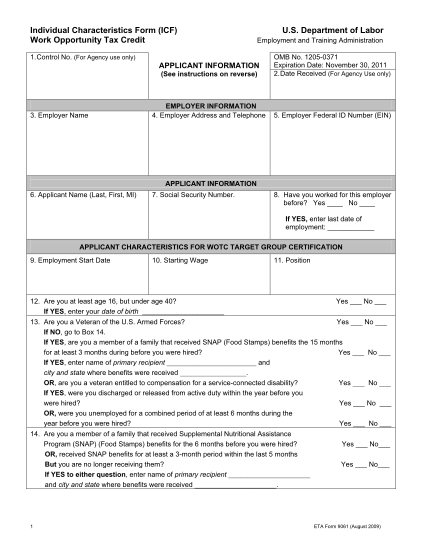

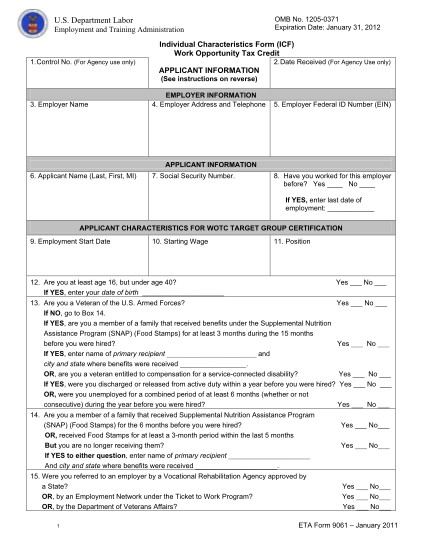

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA Form 9062. This tax credit is for a period of six months but it can be for up to 40. By creating economic opportunities this program also helps lessen the burden on other government assistance programs.

As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the WOTC eligibility questionnaire. I dont feel safe to provide any of those information when Im just an applicant from US. Make sure this is a legitimate company before just giving out your SSN though.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. It asks for your SSN and if you are under 40. Complete Edit or Print Tax Forms Instantly.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The credit to for-profit employers is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. Even the US Postal Service is not always the safest way to transmit information With all of the new laws about guarding.

Get answers to your biggest company questions on Indeed. Its asking for social security numbers and all. Employers can claim about 9600 per employee in tax credits per year under the WOTC program.

Below you will find the steps to complete the WOTC both ways. Dont email such sensitive information. This is so your employer can take the Work Opportunity Tax Credit.

If you do not supply the social security number on the application you will likely have to make a trip to the company to fill it in if the employer wants to offer you a job. The work opportunity tax credit can benefit eligible employers and employees. A person becomes eligible when they meet the requirements of belonging to one of the target groups of people that includes Veterans people who have been.

For most target groups WOTC is based on qualified wages paid to the employee for the first year of employment. The Work Opportunity Tax Credit is a voluntary program. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Employers can still hire these individuals if they so choose but will not be able to claim the tax credit. The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them. The owners of the site is Walton management services and it says our company is participating in a federal jobs tax credit program called the work opportunity tax credit program.

Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of employment. Ad Access IRS Tax Forms. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

Its called WOTC work opportunity tax credits. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. It also says that the employer is encouraged to hire individuals who are facing barriers to employment.

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Employers must apply for and receive a. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the work opportunity tax program. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Ad Access IRS Tax Forms.

I dont think there are any draw backs and Im pretty sure its 100 optional. Some companies get tax credits for hiring people that others wouldnt. The Protecting Americans from Tax Hikes Act of 2015 Pub.

Certification status ie which. A company hiring these seasonal workers receives a tax credit of 1200 per worker. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP.

Complete Edit or Print Tax Forms Instantly. 114-113 the PATH Act reauthorizes the WOTC program and Empowerment Zones without changes through. The tax credit amount under the WOTC program depends on employee retention.

What is a tax credit questionnaire. Learn how the WOTC works and who can claim it. Questions and answers about the Work Opportunity Tax Credit program.

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. Felons at risk youth seniors etc. There are two sets of frequently asked questions for WOTC customers.

%20how%20to%20claim%20it%20for%20my%20business.png)

What Is Work Opportunity Tax Credit Wotc Should You Apply For Wotc Nskt Global

Wotc Questions Why Is My Ss And Date Of Birth Required On Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Talent Card Quickviews Avionte Aero

The Work Opportunity Tax Credit How To Gain The Benefits

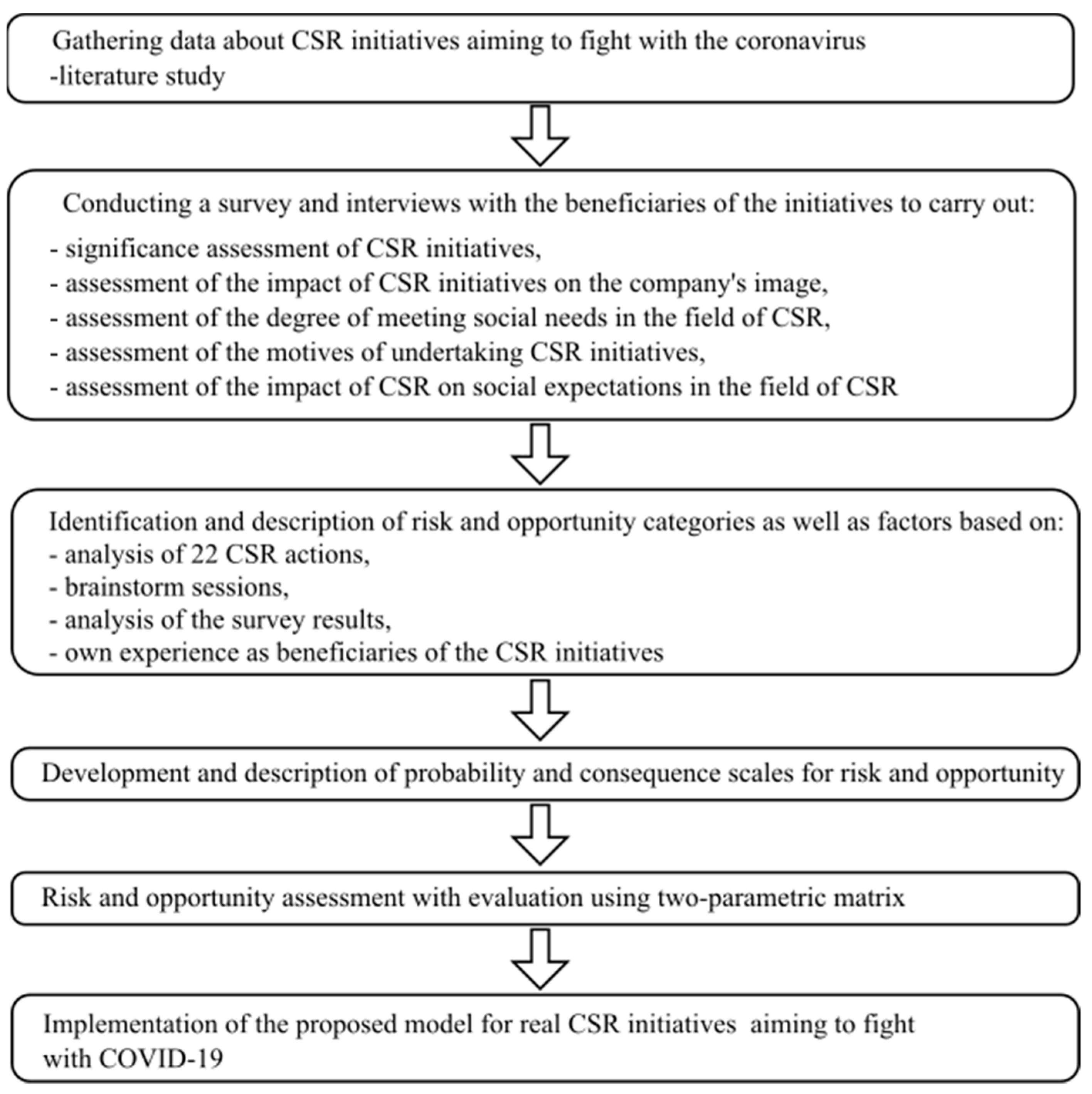

Sustainability Free Full Text Risk And Opportunity Assessment Model For Csr Initiatives In The Face Of Coronavirus Html

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Pdf E Commerce Websites Consumer Order Fulfillment And After Sales Service Satisfaction The Customer Is Always Right Even After The Shopping Cart Check Out

Pdf Theories And Definitions Of The Informal Economy A Survey

21 Printable Review Of Systems Questionnaire Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Landlord 6 Month Inspection Checklist Free To Edit Download Print Cocodoc

Restaurant Job Application Letter How To Write A Restaurant Job Application Let Job Application Letter Template Job Application Template Job Application Form

Pdf Incentives Job Satisfaction And Performance Empirical Evidence In Italian Social Enterprises

14 Business Budget Excel Template Free To Edit Download Print Cocodoc